In the ever-evolving landscape of forex trading, the choice between brokers can significantly impact a trader's journey. As we step into 2024, the comparison between two leading platforms, Interactive Brokers and Eightcap, becomes crucial for both new and experienced forex traders. This article aims to provide an in-depth analysis of these platforms, focusing on key aspects such as regulatory compliance, trading tools, fees, and customer support.

Introduction

Choosing the right forex trading platform is pivotal in navigating the complexities of the global markets. Interactive Brokers and Eightcap have emerged as prominent contenders, each offering unique advantages and limitations. This review delves into the specifics of what these brokers offer, aiming to guide traders in making informed decisions based on their individual trading needs and goals.

Detailed Comparison

Regulatory Compliance and Safety

Interactive Brokers: Known for its global reach, Interactive Brokers is regulated by several authorities, including the U.S. Securities and Exchange Commission (SEC) and the Financial Conduct Authority (FCA) in the UK. This extensive regulatory framework underscores its commitment to providing a secure trading environment.

Eightcap: Similarly, Eightcap boasts regulation by top-tier authorities like the Australian Securities and Investments Commission (ASIC) and the FCA. This ensures that Eightcap adheres to high standards of safety and operational integrity.

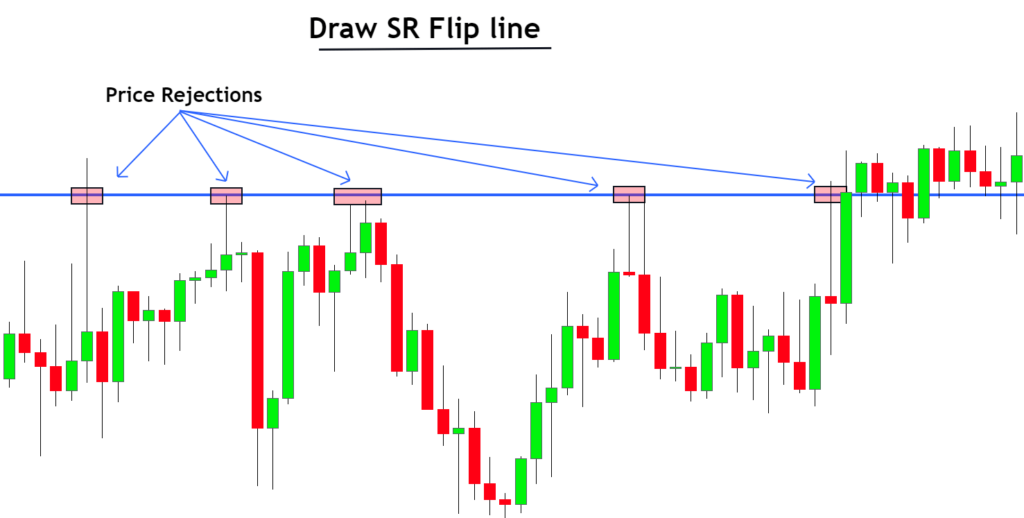

Trading Platforms and Tools

Interactive Brokers: Offers a robust trading platform, Trader Workstation (TWS), known for its comprehensive tools and features suitable for both beginners and professional traders. The platform provides access to a wide range of markets beyond forex, including stocks, options, and futures.

Eightcap: Focuses primarily on forex and CFD traders, offering MetaTrader 4 and MetaTrader 5 platforms. These platforms are renowned for their user-friendly interfaces, advanced charting tools, and automated trading capabilities.

Account Types, Fees, and Spreads

Interactive Brokers: Known for its competitive fee structure, it offers tiered pricing options that can benefit high-volume traders. However, it's important for traders to consider potential inactivity fees.

Eightcap: Offers straightforward account types, including Standard and Raw accounts. The Raw account is particularly attractive for its low spreads and commission-based pricing, making it a suitable option for scalpers and high-volume traders.

Customer Support and Education

Interactive Brokers: Provides extensive educational resources and customer support. Its Trader's Academy is an invaluable resource for traders at all levels, offering courses and webinars on a wide range of topics.

Eightcap: Also places a strong emphasis on education and support, with a dedicated team available 24/5. Its educational resources, however, are more focused on forex and CFD trading.

For an expanded understanding of forex trading strategies and market analysis, traders are encouraged to explore Forex Factory. This platform offers real-time information, expert insights, and a vibrant community for traders.

Conclusion

The comparison between Interactive Brokers and Eightcap in 2024 reveals distinct advantages and considerations for forex traders. Interactive Brokers stands out for its broad market access and sophisticated trading tools, catering to a diverse investor base. Eightcap, on the other hand, offers a more forex-focused experience with competitive spreads and user-friendly platforms. Ultimately, the choice between these brokers should align with the trader’s specific needs, trading style, and market preferences. By considering each platform’s regulatory framework, trading tools, fee structure, and educational support, traders can navigate the forex market more effectively.