In the dynamic and complex world of online trading, the integrity and fairness of a broker are of paramount importance to traders. Among the myriad of questions that arise when selecting a broker, concerns about manipulation stand out as crucial. Specifically, traders often ask, "Does IC Markets manipulate market conditions or trading platforms to its advantage?" This article seeks to address these concerns by examining the regulatory framework governing IC Markets, the transparency of its operations, its technological infrastructure, client feedback, and how these factors contribute to answering this pressing question.

Regulatory Framework

IC Markets is regulated by several high-profile regulatory bodies, including the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), and the Seychelles Financial Services Authority (FSA). These organizations are known for their strict regulatory standards, which include oversight of operational practices, financial compliance, and the protection of client interests. These regulations are designed to prevent manipulation and ensure fair trading practices. For a broker to maintain its regulatory status, adherence to these principles is not just encouraged but mandated.

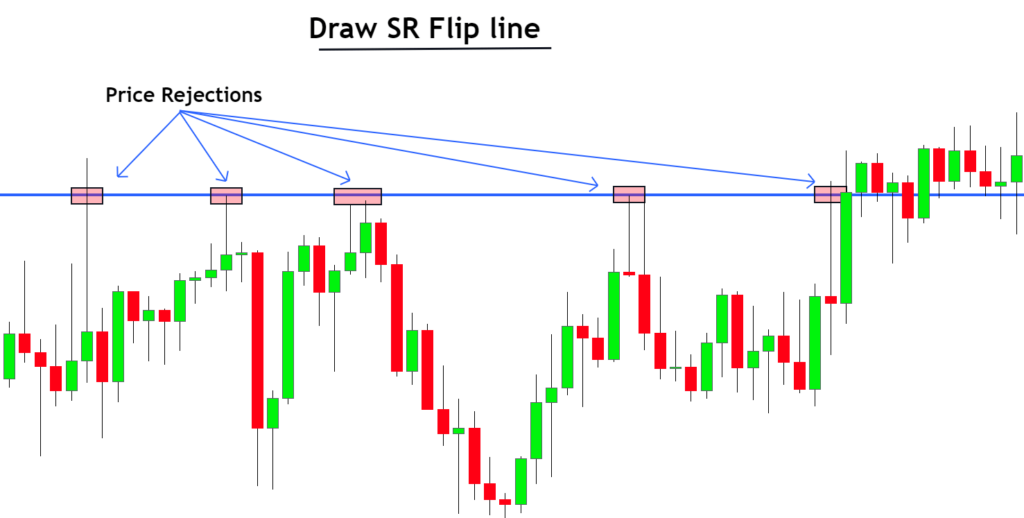

Transparency and Fair Trading

Transparency in trading operations and conditions is a critical factor in assessing whether a broker like IC Markets engages in manipulation. IC Markets is known for its commitment to providing transparent trading conditions. This includes clear information on spreads, commissions, leverage options, and detailed contract specifications for all trading instruments offered. By ensuring that all traders have access to this information, IC Markets promotes an equitable trading environment where decisions can be made with confidence in the fairness of the market.

Technological Infrastructure

The technological infrastructure of a trading platform can also shed light on the integrity of its operations. IC Markets uses advanced trading platforms such as MetaTrader 4, MetaTrader 5, and cTrader, which are equipped with features to ensure trade execution fairness. These include real-time price feeds, low latency execution, and no requotes, minimizing the potential for price manipulation. Furthermore, the use of tier-1 banking partners and liquidity providers ensures that traders receive the best possible prices, further mitigating concerns about manipulation.

Client Feedback and Reputation

Feedback from existing and former clients provides invaluable insights into the operations of a broker. In the case of IC Markets, the vast majority of client testimonials and reviews are positive, with traders praising the broker's transparency, reliability, and execution speed. While no broker is immune to criticism, the nature and frequency of complaints can be indicative of systemic issues. For IC Markets, complaints related to manipulation are exceptionally rare and often stem from misunderstandings about market dynamics rather than evidence of wrongdoing.

Industry Practices and Standards

It's also important to consider IC Markets' position within the broader industry context. The online trading market is highly competitive, with brokers continuously striving to offer better conditions and services to attract traders. In such an environment, engaging in manipulation would not only risk regulatory sanctions but also damage a broker's reputation irreparably, leading to loss of business. IC Markets, by adhering to industry best practices and maintaining a strong regulatory compliance record, demonstrates its commitment to upholding the highest standards of integrity and fairness.

Conclusion

In conclusion, based on the regulatory oversight, commitment to transparency, advanced technological infrastructure, positive client feedback, and adherence to industry best practices, there is no evidence to suggest that IC Markets engages in manipulation of market conditions or trading platforms. While skepticism is natural in the highly scrutinized world of online trading, it is essential to differentiate between market volatility and genuine concerns of unfair practices. IC Markets' operations reflect its dedication to providing a fair and reliable trading environment for its clients.